Venture capital has always been a blend of pattern recognition, instinct, and networking. Now, it’s increasingly intertwined with technology. As deal volumes grow and diligence timelines shrink, investors are leveraging tools to keep pace. Not for novelty’s sake, but to enhance efficiency and decision-making.

Generative AI is at the forefront of this transformation, not just as a standalone tool but integrated into platforms that streamline sourcing, screening, and portfolio management.

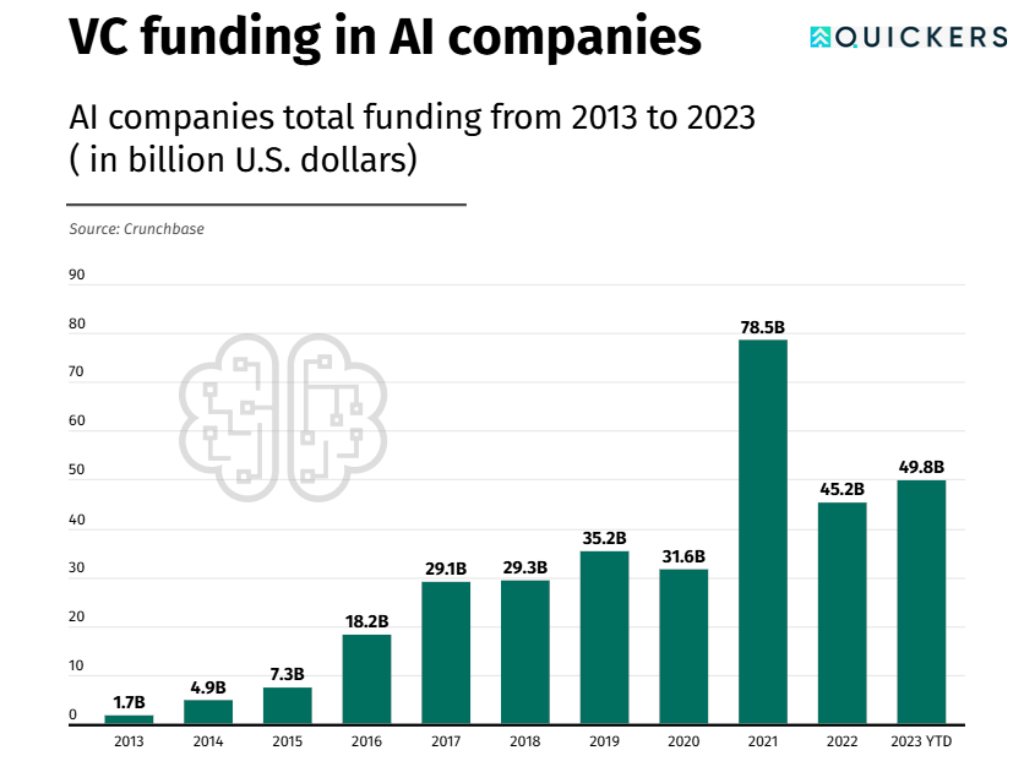

AI startups raised $78.5B in 2021—more than double 2020’s total. Despite a 42% dip in 2022 ($45.2B), funding rebounded in 2023 to $49.8B, up $4.5B year-over-year.

1. Augmented Sourcing: Beyond the Warm Intro

Traditional sourcing relied heavily on networks. Today, platforms like Quickers enable investors to:

- Automate founder discovery: By setting intent-based filters (sector, traction, background), investors can identify startups that align with their interests.

- Contextualize matches: Quickers doesn’t just list potential startups; it provides context, such as links to product demos or relevant publications, aiding in informed decision-making.

Takeaway: AI-enhanced platforms expand the sourcing funnel, ensuring high-potential startups aren’t overlooked due to limited networks.

2. Streamlined Diligence: Efficiency Without Compromise

Diligence remains crucial, but AI tools are making the process more efficient:

- Auto-generated briefs: Quickers can transform startup profiles into concise summaries, highlighting key aspects like go-to-market strategies and potential risks.

- Verification of claims: If a startup asserts a “proprietary LLM stack,” the platform can assess supporting documents and public information to validate such claims.

Takeaway: AI aids in early-stage diligence, allowing investors to focus on deeper analysis and strategic discussions.

3. Enhanced Portfolio Management: Data-Driven Decisions

Managing a portfolio requires continuous monitoring and analysis. Quickers offers:

- AI-powered reporting: Track over 35 KPIs across finance, IT, and marketing, providing real-time insights into portfolio performance.

- Custom dashboards: Tailor views to focus on metrics most relevant to specific investment strategies.

Takeaway: Integrating AI into portfolio management ensures timely insights, facilitating proactive decision-making.

4. Facilitated Fundraising: Connecting the Dots

For startups, securing funding is a critical milestone. Quickers supports this by:

- Investor matchmaking: Utilizing AI algorithms to connect startups with investors whose interests align with their business models.

- Streamlined processes: Automating aspects of fundraising, from contract generation to transaction execution, ensuring efficiency and compliance.

Takeaway: Platforms that bridge startups and investors, backed by AI, can accelerate the fundraising journey.

Final Thought: Embracing the AI-Enhanced VC Landscape

Generative AI isn’t replacing the human elements of venture capital; intuition, relationships, and judgment remain paramount. However, integrating AI through platforms like Quickers equips investors with tools to operate more efficiently and make informed decisions.

For founders, understanding this shift means being prepared for more data-driven interactions and leveraging similar tools to present their ventures compellingly.

In this evolving landscape, the synergy between human insight and AI capabilities defines the new frontier of venture capital.