Sales

Join and earn Quick AI Credits!

Sales

Join and earn Quick AI Credits!

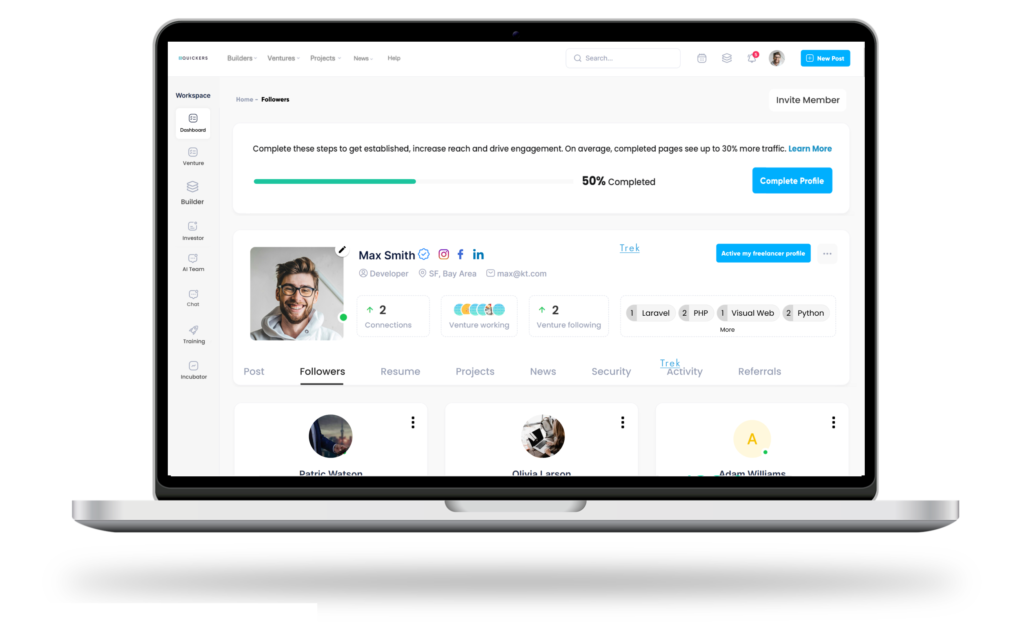

Quickers’ SaaS platform simplifies portfolio management and creation for startups and complex projects. With powerful investment KPIs and advanced evaluation tools, you can effortlessly analyze and enhance your portfolio, driving greater success and growth.

Master Your Venture Portfolio: Streamline, Analyze, and Excel

Centralize and simplify your portfolio management on a single platform

Leverage AI advanced analytics and KPIs for informed decision-making.

Collaborate with peers to craft a dynamic and diversified investment portfolio

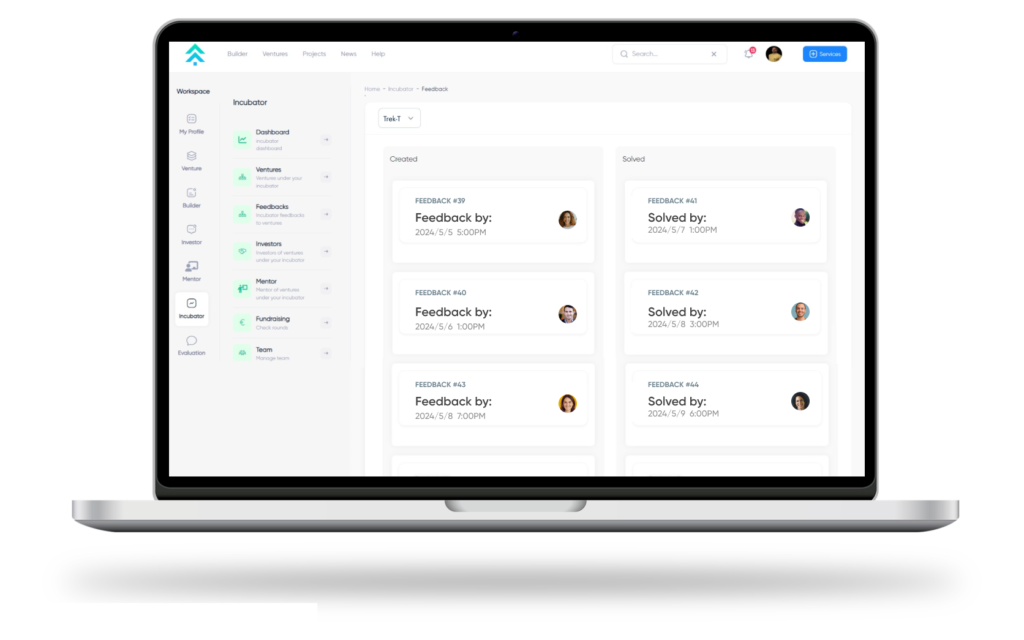

Portfolio managers can use Quickers Venture to send direct feedback to startups during the business planning phases or after milestone evaluations or investor meetings, helping them refine their strategies and operations.

Regular performance reviews can be conducted through the platform, allowing for structured feedback sessions that help startups align better with market expectations.

Host webinars where portfolio managers share insights on common pitfalls and success strategies, providing collective feedback to multiple startups simultaneously

Share early-stage ideas with a selected group of investors and mentors to obtain initial reactions and suggestions, helping to shape the concept before further development.

Organize sessions where mentors can provide detailed evaluations on business models, market viability, and scalability, offering startups valuable insights.

Investors, mentors, and program managers at early stages can assist in evaluating the go-to-market strategy, capitalization, innovation, and other critical startup variables

Understanding the valuation of ideas and businesses is crucial for effective portfolio management. Quickers Venture provides tools to assess valuation and manage the talent pool, including reallocating founders to new projects if needed.

Utilize built-in valuation calculators that consider various metrics and market conditions to estimate the worth of startups, aiding in investment decisions.

In cases where a project may not meet its objectives, Quickers facilitates the process of reallocating founders to other projects where their skills can be better utilized, maximizing resource efficiency and supporting career growth.

Empower portfolio management with advanced tools for automated building, real-time KPI tracking driving success in the startup ecosystem

The Smart Portfolio Builder automates portfolio creation, selecting startups based on key metrics and strategic goals with algorithm-driven selection, customizable filters, and scenario planning.

The KPI Tracker enables portfolio managers to monitor essential performance indicators across startups with real-time insights. It offers live tracking, customizable dashboards to highlight relevant KPIs, and automated alerts for key metric changes.

The Integrated Communication Hub centralizes communication between portfolio managers, startups, and investors, enhancing collaboration with centralized messaging, secure document sharing, and scheduled updates for consistent communication.

Graduating from our program certifies your startup as “Investible,” signaling readiness for external investments with risk scoring, scenario analysis, and mitigation strategies in place.

The Exit Strategy Planner helps optimize exit strategies to maximize returns by offering market timing insights, scenario comparisons, and stakeholder alignment.

The Advanced Analytics Suite provides deep data analysis tools, offering insights into portfolio performance and market trends with data visualization, predictive analytics, and custom reports.

See how Quickers Venture Builder drives innovation with advanced Deep Tech Infrastructure

Découvrez comment Quickers Venture Builder stimule l’innovation grâce à une infrastructure Deep Tech avancée.