In the fast-paced and often unpredictable world of startups, passion, grit, and innovation are essential ingredients for building something remarkable. But when it comes to securing venture capital (VC) funding, there’s another equally crucial factor many founders overlook: understanding investor sentiment and aligning with VC interests in your sector.

Why Sector Alignment is Crucial for Startup Success

Venture capitalists aren’t just investing in ideas — they’re betting on sectors they believe have the potential to grow, scale, and deliver strong returns. Most VCs focus on specific industries based on market trends, their expertise, and the existing composition of their portfolios.

If your startup falls within a sector that a VC is actively investing in, you’re more likely to get a meeting, and potentially a term sheet. But if your startup doesn’t align with their current interests, even the best pitch may be politely declined.

Key Questions Every Founder Should Ask

Before you approach investors, ask yourself the following questions to gauge sector alignment:

1. Is your sector currently attracting VC attention?

Sectors like artificial intelligence (AI), fintech, sustainable energy, and healthtech have seen tremendous growth and investor interest in recent years. On the other hand, some industries may temporarily fall out of favor due to market shifts, regulation, or saturation.

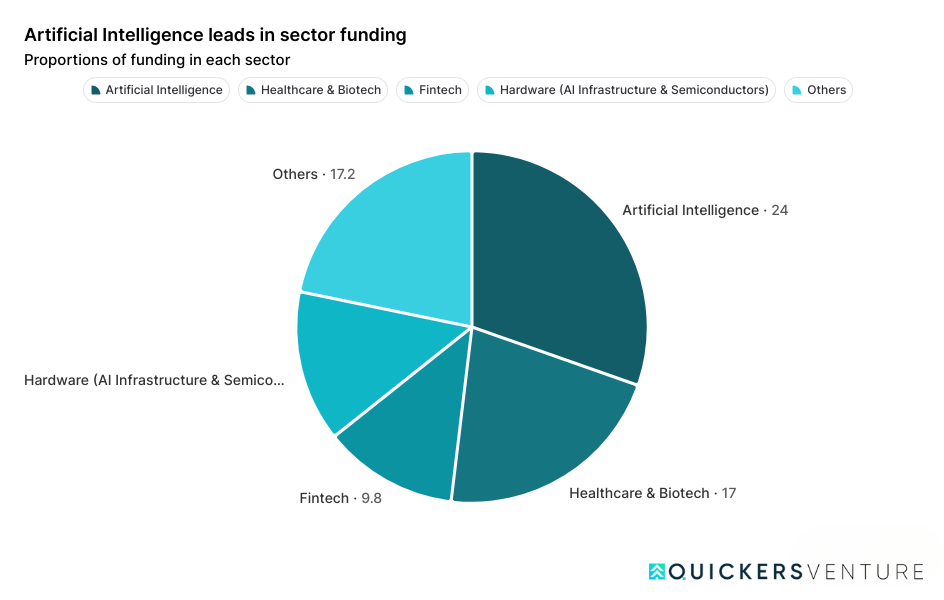

Source: Crunchbase – 2025 Global VC Report

As shown in the chart above, AI leads VC interest in 2025, followed closely by Healthcare, Biotech, and Fintech. Founders in these sectors may find it easier to gain investor traction.

2. Does your startup align with the VC’s portfolio strategy?

Even if your idea is promising, a VC may pass if it doesn’t fit their existing investment thesis. Most venture firms look for synergies across their portfolio, aiming to create networks where their investments complement one another.

3. Are there recent exits or wins in your space?

Investor interest often follows success stories. If there have been recent acquisitions, IPOs, or significant funding rounds in your sector, this could reignite VC attention and make your startup more appealing.

Proven Strategies for Founders

So, how can you leverage sector alignment to your advantage? Here are some practical steps to take:

1. Research Potential Investors Thoroughly

Before pitching, dig deep into a VC’s past investments. Use tools like Crunchbase, PitchBook, or VC websites to find out which sectors they’re passionate about. Are they doubling down on AI? Do they avoid hardware startups? The more you know, the better you can position your pitch.

2. Tailor Your Pitch to Sector Trends

Don’t deliver a generic pitch. Instead, show how your startup taps into current market trends or solves an emerging problem in your industry. Highlight your understanding of the sector and demonstrate why now is the perfect time to invest.

3. Build Meaningful Relationships

Cold emails can work, but warm intros work better. Attend industry events, webinars, and startup networking sessions to connect with investors. Building relationships gives you access to behind-the-scenes insights, like what sectors a VC is currently excited about.

4. Stay Informed and Agile

Subscribe to industry newsletters, follow VC blogs, and monitor tech media to keep up with the ever-changing investor landscape. If sector sentiment shifts, be ready to adjust your messaging or even pivot your business model if needed.

Final Thoughts: Passion Meets Strategy

As a founder, your passion is what keeps you going through long nights, tough decisions, and countless pivots. But passion alone isn’t always enough to secure funding. By aligning your startup with VC sector preferences. you dramatically improve your chances of attracting the right investors at the right time.

Remember: fundraising isn’t just about selling your vision, it’s about showing how your vision fits into a larger market narrative that VCs, including Quickers Venture, are already invested in.