If you’re measuring AI by how often it’s used—not by what it delivers—you’re already off-track.

Private equity firms are investing millions in AI. Portfolio companies are piloting tools, rolling out dashboards, and automating reports. Everyone’s “doing AI.”

This isn’t a tech stack issue. It’s a measurement issue. And it’s already showing up in how deals are sourced, diligence is run, and value creation plans are executed.

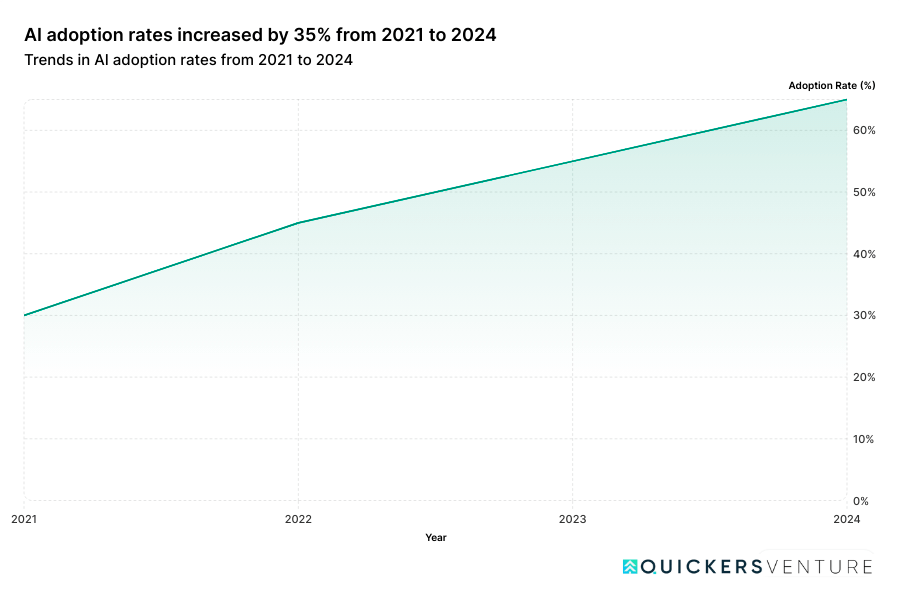

The AI Adoption Boom Is Real—But Misunderstood

A recent Bain & Company report (2024) found that 65% of PE firms have integrated AI into their investment or operations strategy. It’s now considered table stakes.

Source: Bain & Company (2024), mock projection based on market trends.

But there’s a difference between having AI and creating alpha with it.

The problem isn’t that firms aren’t investing. It’s that they’re tracking the wrong things:

- Number of tools used

- Number of portfolio companies “AI-enabled”

- Number of prompts run or dashboards built

These metrics feel good. But they don’t move EBITDA.

In short: we’re confusing motion for momentum.

What AI is Actually Delivering Today

AI, when applied intentionally, can improve operational efficiency. McKinsey’s 2023 report on generative AI estimated $2.6 to $4.4 trillion in annual impact, mostly from process automation, faster coding, and better marketing workflows.

But here’s the catch:

Most of that impact is in cost savings, not topline growth.

So if your private equity firm is using AI to automate internal reporting or summarize board packs, great. You’ll save a few hours. But unless it ties back to revenue, retention, or margins, it’s not building a competitive advantage.

A mid-market SaaS company recently shared with us how they rolled out an LLM-powered support tool. CSAT went up, resolution time dropped, but churn didn’t improve.

Why? Because the real issue was in the onboarding journey, not the support team.

False Confidence, Real Risk

Here’s what makes this dangerous: AI creates a sense of precision. Real-time dashboards. NLP summaries. AI-powered diligence scoring.

It feels like you have a handle on everything. But that’s not how private equity—or real businesses—work.

- Diligence still needs judgment.

- Value creation still needs operating muscle.

- And exits still depend on people, processes, and product/market fit.

Sam Altman put it well:

“AI is not magic. It’s statistics on steroids.”

It can give you a signal. But it won’t give you wisdom.

What Top Firms Are Doing Differently

The most effective PE operators we’ve worked with are flipping the script. They’re not measuring AI usage. They’re measuring impact. Specifically:

- Faster revenue realization → from AI-based GTM playbooks

- Working capital improvements → through predictive ops

- Retention lift → via AI-backed churn modelling tied to human action

- Faster integration → using GenAI for onboarding, documentation, and process standardization

And critically, they’re asking this before any AI rollout:

“What problem are we solving—and how will we know if it worked?”

Everything else is noise.

High-Impact AI Use Cases in Private Equity

| Use Case | Value Driver | Key Metric Tracked |

| AI-Powered Lead Scoring | Revenue Growth | Win rate, pipeline conversion |

| Predictive Ops Planning | Operational Efficiency | Working capital cycle |

| GenAI Support Automation | Margin Improvement | Support ticket cost, CSAT |

| AI for Diligence Parsing | Time-to-Insight | Hours saved per investment |

| AI for Onboarding Docs | Integration Speed | Time to productivity (TTP) |

The Shift: From AI-as-a-Tool to AI-as-a-Lever

If you’re a PE firm today, your edge doesn’t come from having AI. That’s expected. Your edge comes from how precisely you align AI with value creation levers.

That means:

- Mapping AI use cases directly to EBITDA impact

- Tying adoption to KPIs that drive equity value (e.g., faster inventory turns, lower support costs)

- Avoiding AI theater—tools for tools’ sake

This also means pushing portfolio companies to track fewer, more meaningful metrics, not just flood reports with AI usage charts.

Closing Thought: Founders Don’t Need More Tools. They Need More Clarity.

Most founders are already overwhelmed. The last thing they need from a PE sponsor is a 6-tool AI stack with vague outcomes.

What they really need is a clear strategy, sharp focus, and aligned incentives.

If AI helps with that? Great. If not? Cut it.

At Quickers, that’s exactly how we think: no fluff, just outcomes.

Because in the end, you don’t get paid for adoption. You get paid for results.