The new due diligence filter isn’t just tech—it’s AI fluency.

Investors Aren’t Asking If You Use AI. They’re Asking How.

A year ago, mentioning AI in your pitch deck might have earned you a few extra nods. Today, if it’s missing, you’re behind. The 2025 investor isn’t just curious about your use of AI—they expect it to be baked into your operating model, not bolted on as a feature

Whether you’re raising a Seed round or plotting your Series B, AI is now part of the baseline due diligence for most VCs. It’s not about hype. It’s about survival—and leverage.

1. AI Is the New “Cloud”—Invisible, Essential, and Expected

Think about how cloud computing went from buzzword to background utility. The same is happening with AI.

A recent Sequoia Capital report noted that over 70% of early-stage term sheets in Q1 2025 included questions about AI integration, regardless of industry. That’s not just for AI-first startups. It’s B2B SaaS, consumer, logistics, fintech—everyone.

Founders who treat AI as an optional layer or post-launch optimization are missing the point. Investors are looking for defensibility, efficiency, and scale. AI enables all three—if it’s embedded into the product, ops, or growth model.

Takeaway: Don’t just say “we use AI.” Show how it gives you a structural advantage—faster onboarding, lower CAC, dynamic pricing, better LTV prediction, etc.

2. Founders Need to Show AI Literacy, Not Just AI Use

It’s no longer enough to say you’re “using ChatGPT” or building “with OpenAI APIs.” The AI-native founder understands tradeoffs: cost per inference, latency vs. accuracy, when to fine-tune vs. prompt engineer. Investors don’t need you to be an ML engineer—but they expect you to speak the language of AI economics.

For example, Quickers isn’t just offering AI solutions—they’re helping startups architect them intelligently. Their generative AI consulting services come with custom pipelines, domain-tuned models, and infra-level guidance. That kind of technical depth wins trust in a pitch.

Takeaway: Make your AI story about decisions and design, not just tools. Include metrics: cost per user query, model update cycles, time saved in ops.

3. AI-Driven Efficiency Is Becoming Your Margin Driver

Let’s talk cash flow. Startups often live or die on runway extension, and this is where AI isn’t just a feature—it’s a lifeline.

A startup using AI for customer support can reduce headcount while improving responsiveness. Sales enablement tools built on AI can surface ICP leads automatically. Platforms like Quickers help startups apply these optimizations across departments—from AI-enhanced hiring pipelines to smart product development workflows.

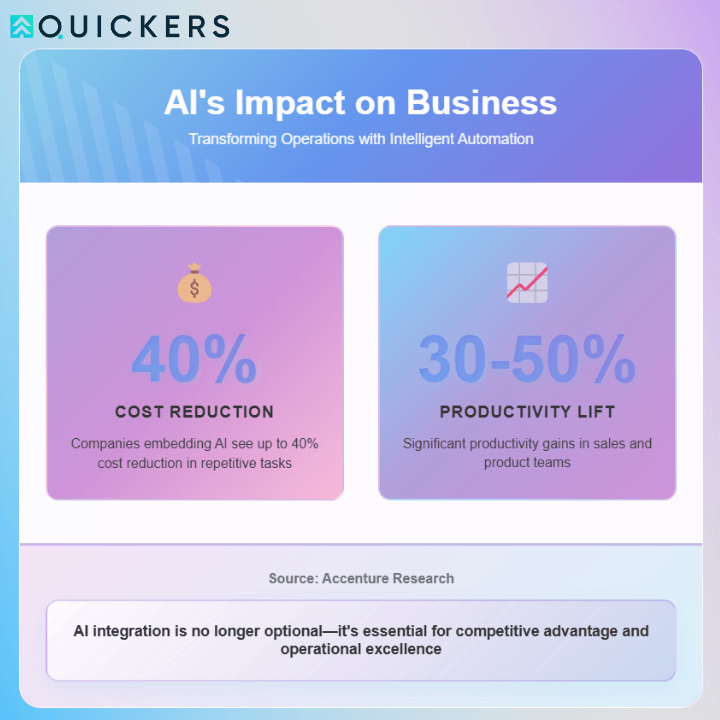

And the ROI is real. According to Accenture, companies embedding AI in operations see up to 40% cost reduction in repetitive tasks, and 30–50% productivity lift in sales and product teams.

Takeaway: In your pitch, don’t just show revenue growth. Show how AI helps you spend smarter. Efficiency is strategy.

3. VCs Are Betting on Systems, Not Just Features

Too many decks still treat AI like a feature slide. “We have a chatbot.” “We use AI to generate reports.” That’s not a moat. That’s a widget.

The best decks frame AI as a systems-level advantage. Think:

- Proprietary datasets

- AI-enhanced workflows

- Learning loops that improve with scale

- Embedded intelligence across UX, ops, and sales

This is where Quickers’ engineering DNA shows. Their AI and software teams don’t just build features—they co-design systems that learn, adapt, and differentiate with usage.

Takeaway: Reframe AI in your deck from what it does to how it compounds. Show the feedback loop.

5. The Bar Is Higher, but the Tools Are More Accessible

The good news? You don’t need a 20-person ML team anymore to ship something smart. Thanks to platforms like Quickers Venture, you can plug into pre-built AI accelerators, integrate domain-specific models, and test use cases within weeks.

The bad news? Because it’s easier, investors expect more polish, more thought, and more sophistication earlier.

If your deck doesn’t reflect a credible, thought-through AI layer—expect to get pressed on it. Worse, you may not even make the first shortlist.

Takeaway: Borrow firepower where needed, but own the strategic thinking. AI is no longer R&D—it’s GTM.

Final Thought: AI Is a Literacy Test—Pass It or Miss the Round

You don’t need to rebrand as an AI startup. But you do need to demonstrate AI fluency—because investors now see it as a proxy for how sharp, scalable, and future-ready you are.

This isn’t about trend-chasing. It’s about building with leverage from Day 1. And in 2025, leverage means AI in the right places, aligned with your mission, not a distraction from it.

If you need help operationalizing AI—from your deck to your data layer—Quickers isn’t just another service provider. It’s a technical co-founder in your corner.

No fluff. No gimmicks. Just signal.

Now go make that deck speak your future—intelligently.