Let’s not sugarcoat it—2024 was brutal for startups raising capital. But it wasn’t a collapse. It was a recalibration.

The fundraising world hit pause. The game changed. And those of us paying attention saw a deeper shift: investors didn’t lose faith—they just got serious.

Over $300 billion vanished, and VC fundraising dropped by a staggering 52%, according to Bloomberg’s 2025 Private Equity & Venture Annual. IPOs almost disappeared. M&A activity slowed to a crawl. It wasn’t just a bad quarter; it was a paradigm shift in how capital flows.

But amid the noise, one thing became clear: startups that moved with clarity, purpose, and discipline still raised. Not because they were lucky, but because they were prepared.

As 2025 begins, we’re not back to easy rounds and fast exits. We’re entering an era where capital follows conviction, not hype. And that’s good news for real builders.

The New Reality: Investors Aren’t Gone, Just Picky

Here’s what happened:

VCs didn’t run out of money—they ran out of patience. The total capital raised in 2024 was less than half of what we saw in 2021 or 2022. Most of the remaining dry powder was reserved for follow-on funding, not first-time bets. Growth funds were hit hardest, while venture barely hung on, buoyed by a surge of AI-led enthusiasm.

Founders with half-baked pitches, generic GTM strategies, or no clear path to profit? They didn’t make it past the first Zoom call. But those with lean metrics, focused teams, and a real sense of purpose? They didn’t just raise—they laid the foundation for the next decade of company-building.

Exit? What Exit?

One of the hardest pills to swallow: liquidity dried up. 2024 saw one of the lowest years for startup exits in the past decade. IPOs barely cracked the surface, and most acquisitions were distressed sales or talent plays.

So, where does that leave us?

Well, it means you can’t pitch your company with the assumption of a flashy exit in 24 months. Instead, you need to show that your company can endure, with or without venture funding. Can your revenue grow without raising again? Can you reach profitability on this round? Can you become indispensable to your customers?

Those are the questions VCs are asking—and they’re right to ask them.

There’s Still Money—But It’s Not for Tourists

Despite the gloom, venture capitalists still poured billions into companies that made sense. AI, infrastructure, logistics, vertical SaaS with hard numbers—these got funded.

But if you’re a first-time founder, especially at the pre-seed stage in Europe, expect an uphill climb. Fund formation in Europe lagged behind North America by more than 2.5x, leaving fewer firms writing early checks. And unlike previous years, founders without warm intros found themselves locked out of the room.

Cold outreach isn’t dead—but it’s no longer enough. Relationships, credibility, and momentum now matter more than ever.

AI Wasn’t Just a Trend—It Was the Backbone of 2024 Venture Capital

In a year where most sectors struggled to attract fresh capital, AI stood out, not as a buzzword, but as infrastructure.

The biggest checks didn’t go to the hundredth chatbot or novelty app. They went to the builders behind the scenes: the companies powering compute, scaling model performance, and optimizing data infrastructure. Pacific Fusion raised $900 million not for surface-level sizzle, but because it’s laying the foundation for how AI scales safely and affordably.

AI absorbed 80% of seed-stage venture dollars in 2024. If you’re not an AI company, that doesn’t disqualify you, but it does raise the bar. Investors are asking: how do you fit into the AI stack? What’s your adjacency? Your edge? Your moat?

VCs aren’t looking for forced narratives; they’re looking for thoughtful positioning. Relevance to AI—even indirectly—might be the wedge that gets you into the room.

Geography Matters Again

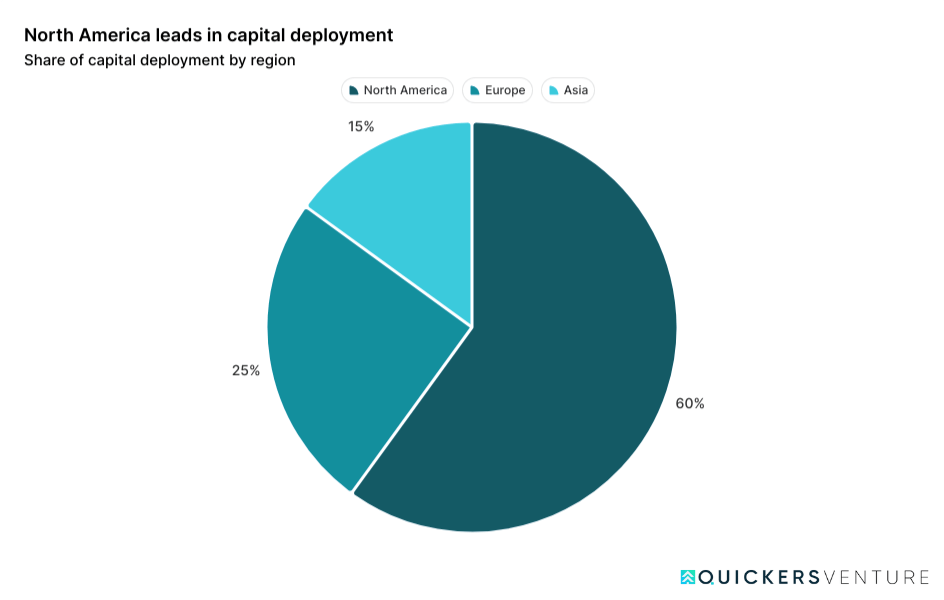

In 2024, over 60% of new VC capital came from North America. Europe and Asia trailed far behind, with investors becoming more risk-averse in unfamiliar geographies. The global fundraising fantasy, where a deck gets you meetings in six time zones, is gone. At least for now.

Source: Bloomberg Private Equity & Venture Annual Report 2025

Instead, we’re back to regional trust. To coffees. To the cultural context. Investors are backing what they know.

If you’re in Spain, Italy, or Pakistan, your best shot at pre-seed success comes from finding local investors who understand your market, your customers, and your constraints.

What You Should Really Take Away

Great companies are forged in hard markets, not frothy ones. You don’t need to be in the top 1% of hype—you need to be in the top 1% of clarity, consistency, and execution.

You’re not pitching a fantasy exit. You’re building something real—something customers rely on, something that grows because it works, not because it’s well-funded.

Start now. Sharpen your numbers. Cut the fluff. Invest in real storytelling, not storytelling tricks.

At Quickers.com, we work with founders across Europe to help them raise smarter and stay investor-ready—even in markets like this.

And remember: in 2025, the founder who rises won’t be the loudest. It’ll be the one who’s ready.