The venture capital landscape just rewrote the rules—and 80% of founders are still playing by the old playbook.

Three months ago, I sat across from Alex, a tech founder who’d just closed his Series A. His eyes lit up as he talked about his 18-month plan to Series B. I didn’t have the heart to tell him he was setting himself up for failure. Today, after analyzing industry data and market trends, I wish I’d been more direct.

The harsh reality: Your Series A needs to last 1,000 days, not 18 months. And the founders who figure this out first will be the ones building investor-ready businesses when the dust settles.

The Great Funding Paradigm Shift

At Quickers, we’ve been observing startup funding patterns across the industry, and the data tells a clear story. The predictable 18-24 month Series A to Series B cycle that defined the 2019-2021 era is dead.

What changed? When the Federal Reserve ended zero interest rate policy in March 2022, it didn’t just affect borrowing costs—it fundamentally altered how venture capital operates. Suddenly, investors couldn’t rely on cheap money to fuel endless growth experiments. They needed businesses that could generate actual returns.

Industry data shows that companies raising Series B rounds in 2025 waited a median of 2.75 years since their Series A. That’s not an anomaly—that’s the new baseline for sustainable startup growth.

The Founder Who Cracked the Code with Data

Let me tell you about Maria, a fintech founder from Barcelona who used Quickers’ strategic planning tools to raise her Series A in early 2022. While her peers were planning hockey stick growth trajectories, she was doing something different: stress-testing her business model for a 3-year runway using comprehensive analytics.

“Everyone thought I was being too conservative,” she recalls. “But I kept asking myself: what if the next round takes twice as long as expected? I planned accordingly.”

That strategic approach saved her company. Today, 30 months later, Maria’s startup is generating $2.8M in annual recurring revenue and is cash flow positive. She’s not desperately seeking Series B investors—she’s choosing whether she even needs them.

Her success demonstrates the power of long-term strategic planning rather than relying on optimistic funding timelines.

Why VCs Changed Their Investment Thesis

The psychology behind venture capital has fundamentally shifted, and industry reports reflect this change. In the low-interest era, VCs could afford to be wrong 7 out of 10 times because the winners would generate massive returns. Now, with alternative investments yielding 4-5% risk-free, the math doesn’t work the same way.

Today’s Series B investors are looking for:

- Proven business models with validated metrics, not just growth numbers

- Clear paths to profitability within 18 months

- Resilient revenue streams that survived economic headwinds

- Teams that can scale efficiently using strategic planning

This isn’t about being picky—it’s about survival. Industry data shows VCs demanding more comprehensive due diligence and longer-term sustainability metrics.

The Bridge Round Trap: What Our Data Shows

Here’s a pattern we’re observing across the startup ecosystem: Founders who planned for 18-month runways are now 24-30 months post-Series A, burning through bridge rounds while desperately pitching Series B investors.

Industry analysis shows that bridge rounds aren’t inherently bad, but they’re often a symptom of poor initial planning. When you’re raising a bridge, you’re negotiating from weakness—something strategic planning helps founders avoid.

The bridge to the death spiral we’ve identified:

- Series A runway runs out at 18 months

- Series B takes longer than expected (our data shows 2.75 years median)

- Emergency bridge round at unfavorable terms

- Dilution increases, founder control decreases

- Series B becomes even harder to raise due to weakened position

Smart founders are avoiding this trap entirely by leveraging strategic planning and conservative financial modeling for extended timeline scenarios.

The Two-Track Strategy That’s Working

The most successful founders aren’t choosing between growth and profitability—they’re building two parallel tracks using comprehensive business planning methodology.

Track 1: The Profitability Path

- Aggressive unit economics optimization with careful tracking

- Sustainable growth rates (30-50% annually) validated through market analysis

- Clear timeline to cash flow positive with milestone planning

- Focus on customer lifetime value optimization

Track 2: The Series B Path

- Maintaining growth metrics that excite investors through strategic execution

- Building strategic partnerships and market positioning

- Demonstrating scalability with comprehensive planning

- Preparing for when capital markets improve with market intelligence

The genius of this approach? You’re not betting everything on one outcome. Strategic planning helps you maintain both tracks simultaneously with clear workflows and milestone-based execution.

What Industry Data Shows About Funding Progression

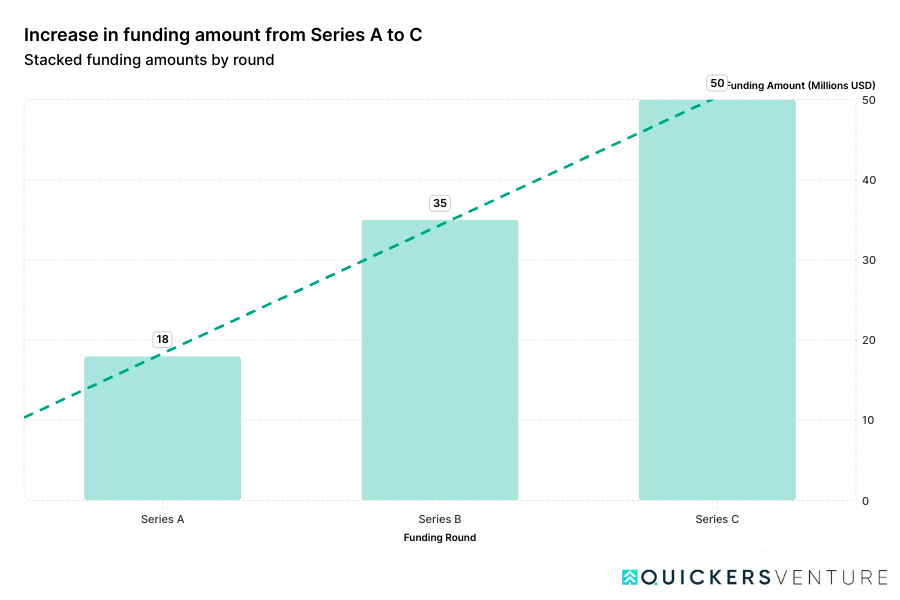

According to Fundz.net analysis, the typical funding progression shows clear patterns: Series A rounds average $18M, Series B rounds $35M, and Series C rounds $ 50 M. However, while funding amounts increase predictably, the timeline to reach each milestone has extended significantly.

Source: Median U.S. Funding by Round – Q1 2024

Based on industry observations, here’s what we’re seeing:

The Survivors (Top 20%):

- Used comprehensive business planning and conservative runway estimates

- Achieved gross margins above 70% within 24 months

- Maintained burn rates below 50% of monthly revenue

- Built diversified revenue streams using strategic approaches

The Strugglers (Bottom 50%):

- Stuck to traditional 18-month runway planning

- Prioritized growth over unit economics

- Single-threaded revenue models

- Expensive customer acquisition strategies without optimization

The middle 30%? They’re the ones raising bridge rounds and hoping for miracle Series B funding—exactly what strategic planning helps founders avoid.

Your Series A Survival Framework

If you’re raising or planning a Series A, here’s your new playbook based on Quickers’ proven methodology:

Financial Planning with AI Insights:

- Model for 36+ months of runway using our forecasting tools

- Build quarterly profitability milestones with automated tracking

- Stress-test your burn rate assumptions through scenario planning

- Plan for multiple growth scenarios with our AI recommendations

Business Model Optimization:

- Optimize unit economics before scaling using our KPI dashboard

- Diversify revenue streams with strategic guidance

- Build recurring revenue components through our business design approach

- Focus on customer retention over acquisition with data-driven insights

Strategic Execution:

- Hire for versatility using our team optimization tools

- Build scalable operations with our workflow automation

- Invest in efficiency improvements guided by our analytics

- Create clear performance metrics with our comprehensive reporting

Investor Relations Management:

- Choose Series A investors who understand the new timeline

- Set realistic expectations about Series B timing using our data

- Build relationships with potential Series B investors through our network

- Maintain regular communication with comprehensive investor reporting

The Competitive Advantage Hidden in Plain Sight

Here’s what most founders are missing: this extended timeline isn’t just a challenge—it’s a massive competitive advantage for those who embrace it with the right tools and insights.

While your competitors are scrambling for bridge rounds, you can be building market-defining products using Quickers’ 360° business design approach. While they’re cutting costs desperately, you can be investing strategically with AI-powered insights. While they’re pitching from weakness, you can be negotiating from strength with comprehensive investor-ready metrics.

The companies that will dominate the next decade are being built right now by founders who understood the 1,000-day reality and equipped themselves with the right platform and insights.

Your Next Strategic Move

The venture capital world has fundamentally changed, and there’s no going back to the easy money era. But that doesn’t mean opportunities have disappeared—they’ve just shifted to founders who can adapt faster using data-driven insights and comprehensive business design.

The 1,000-day Series A isn’t a burden; it’s a filter. It separates the builders from the dreamers, the strategic thinkers from the tactical executors, and the data-driven founders from those relying on gut feelings.

At Quickers, we’re empowering founders to not just survive this transition, but thrive in it. Our platform provides AI-powered insights, investor-ready tools, and a comprehensive business design methodology that turns the 1,000-day challenge into a competitive advantage.

Ready to build your strategic 1,000-day Series A approach? Quickers provides the comprehensive business planning tools, strategic frameworks, and execution methodologies that help founders navigate extended funding timelines successfully.

Start your journey at Quickers.com and access our business model canvas tools, strategic planning frameworks, and comprehensive execution guides that transform how you approach Series A planning.

Have you experienced the extended Series A timeline in your startup journey? What strategies worked for you? Share your story in the comments—every founder’s experience builds our collective knowledge and helps the entire startup community.