A recent report by Sifted initiates an insightful exploration into the landscape of gender diversity within Europe’s startup ecosystem, focusing on the allocation of venture capital (VC) funding into female-founded startups across different regions. This comprehensive analysis sheds light on both progress made and persisting challenges in achieving gender parity within the realm of entrepreneurial finance.

Leadership in Diversity: UK and Ireland

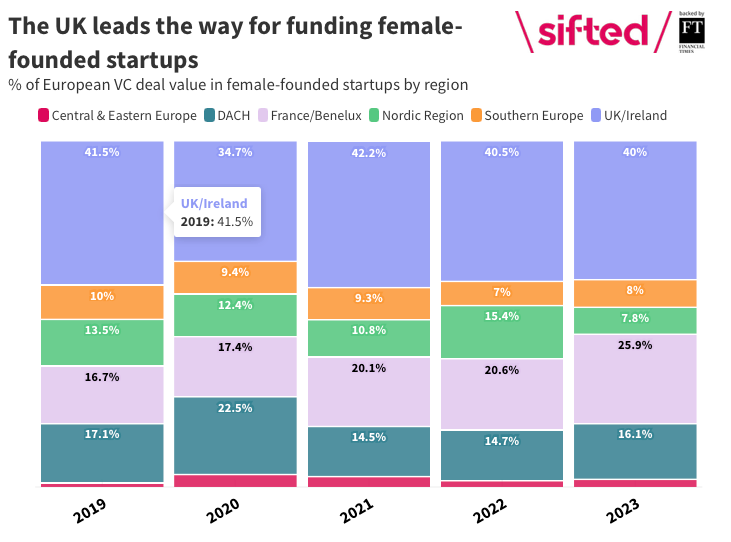

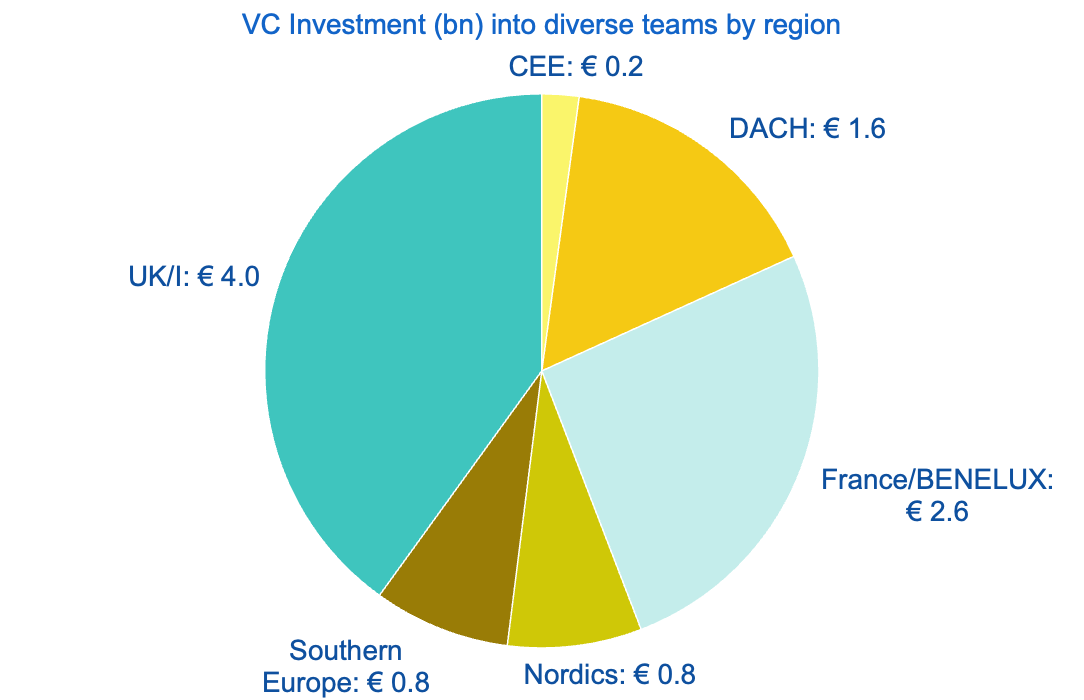

Leading the charge in fostering gender diversity are startups based in the United Kingdom and Ireland. Commanding approximately 40% of the total venture capital invested in female-founded teams across Europe, these regions demonstrate a commendable commitment to supporting and empowering female entrepreneurs. Their consistent leadership position underscores the effectiveness of initiatives aimed at fostering inclusivity and leveling the playing field for aspiring female founders.

France’s Ascendancy: A Promising Trend

In a distant yet noteworthy second place, France emerges as a beacon of progress, securing around 26% of VC funding directed towards female-founded startups. With a trajectory marked by consistent year-on-year improvement, France’s rise reflects concerted efforts to address gender disparities and nurture a more inclusive startup environment. This upward trend signals a positive shift towards greater gender diversity and opportunities for female entrepreneurs to thrive.

DACH Region: Steadfast Support

The DACH region, comprising Germany, Austria, and Switzerland, asserts its presence as a stalwart supporter of gender diversity in entrepreneurship. Garnering a relatively consistent share of 16% of VC funding into female-founded teams, the region exemplifies a steadfast commitment to fostering an environment where female entrepreneurs can flourish. While maintaining a solid foundation, there remains ample room for growth and innovation to further bolster support for female-led ventures.

Challenges and Opportunities in Nordic Region and Southern Europe

Challenges persist in the Nordic Region and Southern Europe, where both regions currently command a modest share of approximately 8% of VC funding into female-founded startups. However, these figures serve as catalysts for change, highlighting untapped potential and opportunities for growth. By learning from successful strategies implemented in leading regions and prioritizing initiatives aimed at promoting gender diversity, the Nordic Region and Southern Europe can chart a course towards greater inclusivity and empowerment for female entrepreneurs.

In-depth Insights: Unveiling the Investment Discrepancy

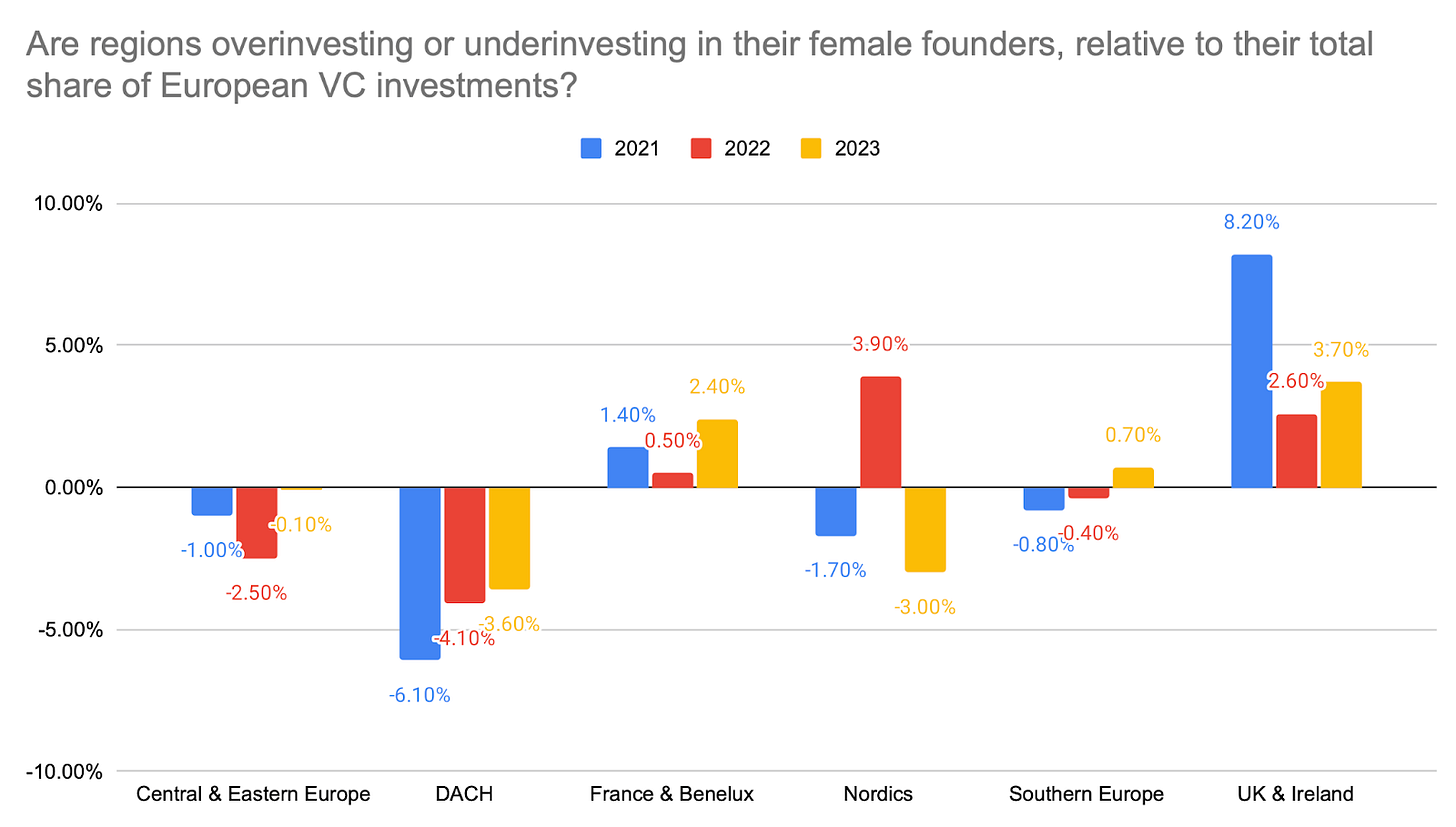

Delving deeper into the investment landscape, a visualization by Sifted, supplemented by data from PitchBook’s “2023 European All In: Female Founders in the VC Ecosystem” report, reveals intriguing insights. The UK and Ireland emerge as frontrunners, with investments exceeding 40% of the total ecosystem investments into diverse teams. Despite facing discrepancies, these regions maintain a commendable track record of over-investment in female-founded teams, underscoring their proactive approach to promoting gender diversity.

Challenges on the Horizon: Addressing the Funding Gap

Despite progress, challenges persist in bridging the funding gap for female-founded startups. A report by Antler highlights that only 1.8% of venture capital in Europe is invested in female-only teams, despite comprising 10% of founding teams. This disparity underscores the urgent need for concerted efforts to address systemic barriers and biases that hinder equitable access to funding for female entrepreneurs.

The Power of Diversity: Transforming the Startup Ecosystem

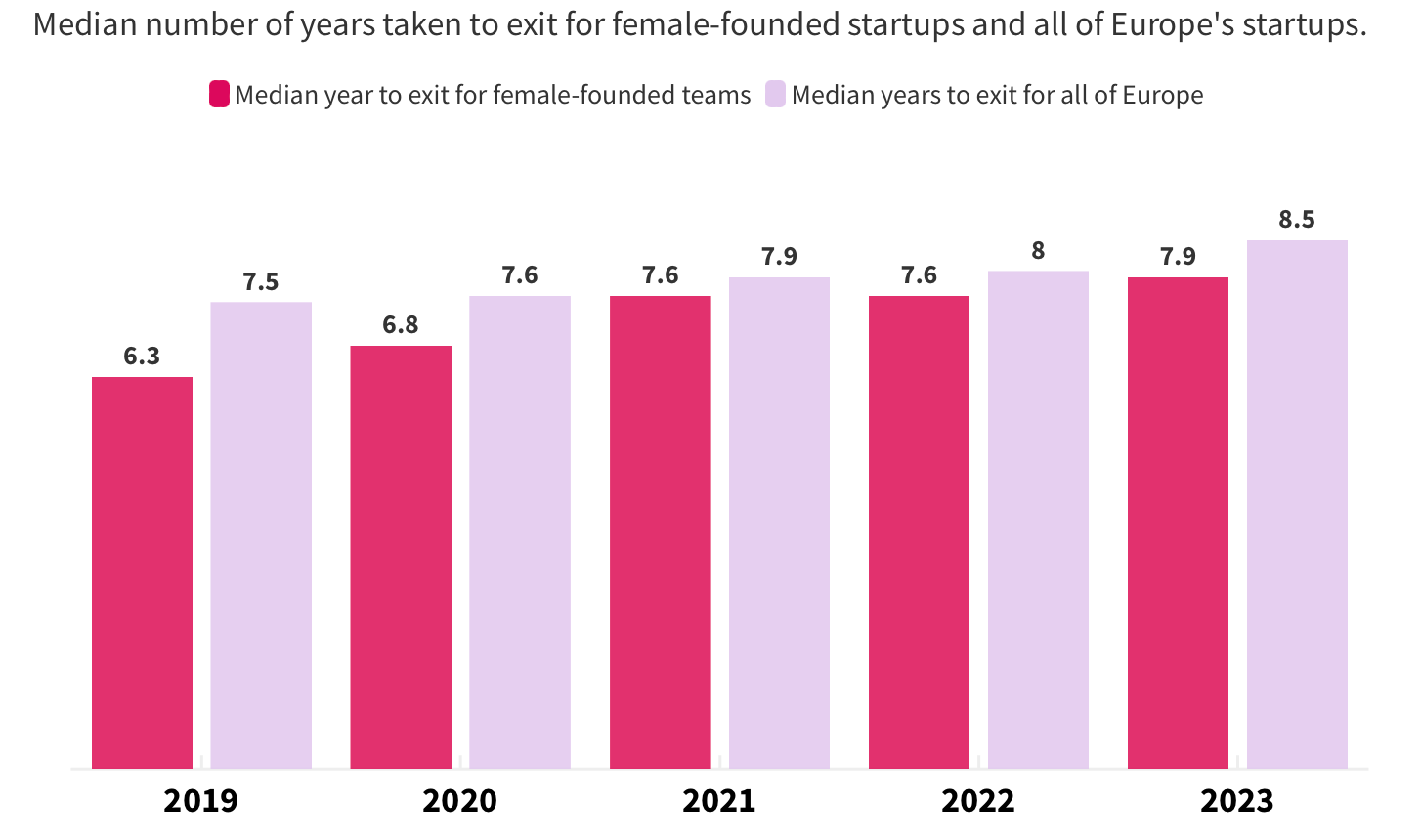

Imagine a startup ecosystem where gender diversity isn’t the exception but the rule. Scientific research shows that increasing diversity in founding teams brings a plethora of measurable benefits for all stakeholders. Diverse founder teams not only achieve better financial outcomes, boasting an average IRR of 112% compared to 48% for non-diverse teams, but they also produce quicker exits and higher valuations. Studies highlight that exits by diverse teams are 9.7% more profitable on average, making them the most likely to succeed and yield substantial returns. Embracing gender diversity in startups isn’t just a matter of fairness—it’s a strategic imperative that drives innovation, profitability, and long-term success.

Venture Capital’s Role: Shaping the Landscape

Venture capital funds play a pivotal role as gatekeepers to capital, yet they too face challenges in fostering diversity within their ranks. Diversity VC reports reveal that only a fraction of US general partners identify as women, highlighting the need for greater representation and inclusivity within VC firms. Research indicates a positive correlation between the presence of female general partners and investments into female entrepreneurs, emphasizing the importance of diversifying VC partnerships to drive meaningful change.

Key Insights: Paving the Path Forward

The journey towards equitable funding is multifaceted, requiring collaborative efforts across stakeholders to effect meaningful change. Women continue to be underrepresented across startup founding teams and VC partnerships, perpetuating systemic inequalities in access to capital. However, research suggests that increasing the representation of female general partners could serve as a catalyst for breaking this cycle, unlocking greater opportunities for female entrepreneurs.

As the UK and Ireland lead the charge towards more equitable funding, the path to change is characterized by persistence and resilience. While progress may be gradual, it is imperative that stakeholders across the ecosystem remain steadfast in their commitment to fostering inclusivity and empowering female entrepreneurs to realize their full potential. Only through collective action and unwavering determination can Europe pave the way towards a more diverse, equitable, and vibrant startup landscape.

Want to See more blogs like this , Checkout our other blogs or subscribe to our Substack channel

My name is Haris saleem and I am a Software Engineer.